ProspX.ai’s Optimize™ Reveals Three Key Mindsets of U.S. EV Buyer

— Automotive Industry Expert

WASHINGTON, DC, UNITED STATES, May 19, 2022 /EINPresswire.com/ — ProspX.ai, known for delivering tomorrow’s mindsets today, conducted its initial automotive retailing study in July 2020, which uncovered the need for a refined eCommerce retailing strategy when approximately 2 percent of new vehicles were sold online — now 30%. Now ProspX.ai announces its proprietary U.S. Electric Vehicle (EV) study, “Future EV Adopter Mindsets: The Next Wave.” The study identifies the mindsets and drivers to getting the next waves of EV buyers/lessees to acquire an EV when shopping for a new vehicle.

“Traditional automotive OEMs are expanding the types of vehicles and the brands they are leveraging to offer EV models. They are also realigning their businesses to accommodate the transition from ICE to EV production and increasing their production targets, but U.S. consumers interest in acquiring EVs appears pragmatic and cautious.” said Stephen Newman, CEO, at ProspX.ai. Newman further stated, “There will be a paradigm shift in terms of what is important to future EV buyers vs. Early Adopters, and our study identified three distinct mindsets of potential EV shoppers and how best to communicate the benefits of acquiring an EV to each of them. Understanding what each mindset expects and how that impacts messaging and media buying strategy will be critically important to growing market share.”

Overview

EV adoption is expected to continue to increase, and OEMs are competing for future market share in all vehicle categories, so delivering actionable information about today’s consumer mindsets will further inform the automotive community on key factors the industry and governments should consider.

Accordingly, ProspX.ai used its proprietary Optimize™ platform to conduct a self-funded study to determine: (1) the benefits of buying or leasing an EV; (2) the barriers to buying or leasing an EV; and (3) how can OEMs message consumers to lessen apprehensions regarding buying or leasing an EV. Optimize™ examined drivers to action using specific statements regarding EV pricing, the sales process, EV operating range, type of and costs of charging EVs, and value of EVs.

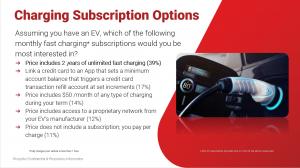

Within days, Optimize™ completed fielding which yielded three, distinct mindset segments — “ICE, ICE Babies,” “Prove Its,” “Traditionals” — and the specific package of attributes that could attract and/or detract each segment from acting on an offer. Other findings include: (1) over 40% of respondents intend to buy/lease an EV in the next 3 years; (2) the practicality of EV ownership outweighs the potential impact on the environment in the decision-making process; (3) in near-term, EVs should NOT be sold solely online; and (4) OEMs should offer a menu of options for charging but 2 years free on a network was best received option.

Detailed Findings

As the EV automotive landscape continues to evolve, so do the needs and expectations of future EV adopters. For example, many believe the major driver of EV sales is concern about ICE vehicles’ impact on the environment. This belief may have been true for a significant number of Early Adopters but it’s more likely that future acquirers will be driven by other wants and needs, i.e., social factors, novelty, image, and practicality. Whereas to convince the Next Wave of acquirers, OEMs need to remember that shoppers will continue to do their homework and they need more proof that EVs are easier to operate and maintain and that EVs have a lower impact on the environment than ICE vehicles.

ICE, ICE Babies (“IIBs” – 29.4%) like their current ICE powered vehicles and don’t want the hassles of switching to an EV. These consumers would only consider owning an EV if their home or work location had an EV charger. They are not interested in being able to charge their EV at stores where they shop or at hotels where they stay. IIBs also don’t like the idea of giving tax incentives for those who purchase or lease an EV. It may take a while for most people with this mindset to acquire an EV.

Prove Its (“PIs” – 38.3%) are knowledgeable EV shoppers who need all their boxes checked before they would acquire an EV. These consumers like the idea of fast charging — plugging an EV into a higher-powered electrical outlet to charge their EV in less than 1 hour. Plus, they would consider owning an EV even if their home or work location did not have an EV charger. But PIs do not believe that the cost of maintaining an EV is much lower than that of a hybrid, gasoline, or diesel-powered vehicle. And PIs do not want to purchase or lease an EV strictly online. This mindset presents an opportunity because these shoppers are likely to walk dealer lots to touch and test an EV and they want to ask questions about the costs and infrastructure associated with having and operating an EV before they acquire one.

Traditionals (“Ts” – 32.3%) are apprehensive about transitioning to EVs. Traditionals are concerned about potential limitations that may come with acquiring an EV. As an example, they do not like having private networks of charging stations strictly for owners of a specific EV’s manufacturer, like Tesla’s Supercharging Network. But they are not concerned about having the ability to nor believe EVs have the ability to be driven up to 400 miles without a charge. Traditionals are open to acquiring EVs but will proceed with extra caution. They need more positive attributes of EVs to be evident before they feel comfortable acquiring one.

Key Implications

Dealers have an important role in educating and providing tactile access to EVs. In addition, the rationale for acquiring an EV will shift and EV messaging needs to evolve to address the market’s changing needs. Consequently, the automotive community could benefit by further understanding consumer mindsets. Specifically, knowing how consumers buying decisions and expectations change over time and how to quickly mitigate any risks and/or barriers to capitalizing on marketplace opportunities. Each OEM needs to understand how their brands, products, and services fit within the spectrum of consumer mindsets.

To download the detailed report, including all implications and recommendations, please visit https://www.prospx.ai/industry-studies/.

David Charmatz

ProspX.ai

+1 720-219-5794

David@prospx.ai

Visit us on social media:

Facebook

LinkedIn