[ad_2]

NEW YORK, July 28, 2021 /PRNewswire/ —

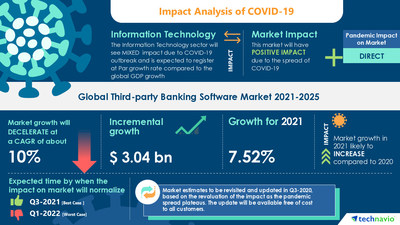

According to Technavio, incremental growth of USD 3.04 billion is expected in the third-party banking software market during 2021-2025. The report offers a detailed analysis of the impact of the COVID-19 pandemic on the third-party banking software market in optimistic, probable, and pessimistic forecast scenarios.

Download a Free Sample Covering COVID-19 Impact Analysis

The market is fragmented, and the degree of fragmentation will decelerate during the forecast period. Accenture Plc, Capgemini Services SAS, Fidelity National Information Services Inc., Fiserv Inc., Infosys Ltd., International Business Machines Corp., Oracle Corp., SAP SE, Tata Consultancy Services Ltd., and Temenos AG are some of the major market participants. Although the growing use of digital payment solutions will offer immense growth opportunities, to leverage the current opportunities, market vendors must strengthen their foothold in the fast-growing segments, while maintaining their positions in the slow-growing segments.

Third-party Banking Software Market 2021-2025: Segmentation

Third-party Banking Software Market is segmented as below:

- End-user

- Retail Users

- Corporate Users

- Deployment

- On-premises

- Cloud-based

- Application

- Core Banking Software

- Asset And Wealth Management Software

- Other Banking Software

- Geography

- Europe

- North America

- APAC

- South America

- MEA

To learn more about the global trends impacting the future of market research, download a free sample: https://www.technavio.com/talk-to-us?report=IRTNTR40555

Third-party Banking Software Market 2021-2025: Vendor Analysis and Scope

To help businesses improve their market position, the third-party banking software market provides a detailed analysis of around 25 vendors operating in the market. Some of these vendors include Accenture Plc, Capgemini Services SAS, Fidelity National Information Services Inc., Fiserv Inc., Infosys Ltd., International Business Machines Corp., Oracle Corp., SAP SE, Tata Consultancy Services Ltd., and Temenos AG.

The report also covers the following areas:

- Third-party Banking Software Market size

- Third-party Banking Software Market trends

- Third-party Banking Software Market industry analysis

The increased need for greater customer satisfaction is likely to emerge as one of the primary drivers of the market. However, issues related to data privacy and security may threaten the growth of the market.

Register for a free trial today and gain instant access to 17,000+ market research

reports.

Technavio’s SUBSCRIPTION platform

Backed with competitive intelligence and benchmarking, our research report on the third-party banking software market is designed to provide entry support, customer profile & M&As as well as go-to-market strategy support.

Related Reports on Information Technology Include:

Global Fintech Software Market – Global fintech software market is segmented by end-user (banking, insurance, and securities) and geography (North America, APAC, Europe, South America, and MEA).

Download Exclusive Free Sample Report

Global E-invoicing Market – Global e-invoicing market is segmented by end-user (B2B and B2C) and geography (Europe, APAC, North America, South America, and MEA).

Download Exclusive Free Sample Report

Third-party Banking Software Market 2021-2025: Key Highlights

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will assist third-party banking software market growth during the next five years

- Estimation of the third-party banking software market size and its contribution to the parent market

- Predictions on upcoming trends and changes in consumer behavior

- The growth of the third-party banking software market

- Analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of third-party banking software market vendors

Table of Contents:

Executive Summary

Market Landscape

- Market ecosystem

- Market characteristics

- Value chain analysis

Market Sizing

- Market definition

- Market segment analysis

- Market size 2020

- Market outlook: Forecast for 2020 – 2025

Five Forces Analysis

- Five forces summary

- Bargaining power of buyers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Threat of rivalry

- Market condition

Market Segmentation by Application

- Market segments

- Comparison by Application

- Core banking software – Market size and forecast 2020-2025

- Asset and wealth management software – Market size and forecast 2020-2025

- Other banking software – Market size and forecast 2020-2025

- Market opportunity by Application

Market Segmentation by End-user

- Market segments

- Comparison by End-user

- Retail users – Market size and forecast 2020-2025

- Corporate users – Market size and forecast 2020-2025

- Market opportunity by End-user

Market Segmentation by Deployment

- Market segments

- Comparison by Deployment

- On-premises – Market size and forecast 2020-2025

- Cloud-based – Market size and forecast 2020-2025

- Market opportunity by Deployment

Customer landscape

- Customer landscape

Geographic Landscape

- Geographic segmentation

- Geographic comparison

- Europe – Market size and forecast 2020-2025

- North America – Market size and forecast 2020-2025

- APAC – Market size and forecast 2020-2025

- South America – Market size and forecast 2020-2025

- MEA – Market size and forecast 2020-2025

- Key leading countries

- Market opportunity by geography

- Market drivers

- Market challenges

- Market trends

Vendor Landscape

- Vendor landscape

- Landscape disruption

- Competitive scenario

Vendor Analysis

- Vendors covered

- Market positioning of vendors

- Accenture Plc

- Capgemini Services SAS

- Fidelity National Information Services Inc.

- Fiserv Inc.

- Infosys Ltd.

- International Business Machines Corp.

- Oracle Corp.

- SAP SE

- Tata Consultancy Services Ltd.

- Temenos AG

Appendix

- Scope of the report

- Currency conversion rates for US$

- Research methodology

- List of abbreviations

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focus on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

Report: www.technavio.com/report/third-party-banking-software-market-industry-analysis

Newsroom: newsroom.technavio.com/news/third-party-banking-softwaremarket

View original content to download multimedia:https://www.prnewswire.com/news-releases/third-party-banking-software-market-2021-2025–covid-19-to-positively-impact-market-growth–technavio-301342617.html

SOURCE Technavio

Source link

[ad_2]

The content is by PR Newswire. Headlines of Today Media is not responsible for the content provided or any links related to this content. Headlines of Today Media is not responsible for the correctness, topicality or the quality of the content.

[ad_2]