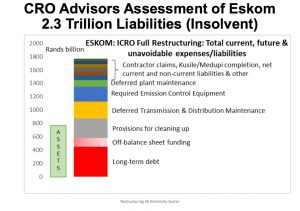

Eskom’s ~500BN debt, ~128BN off balance sheet debt, and 1,572BN in unavoidable cost over next 5 years, are a staggering percentage of South Africa’s total debt.

— KW Miller, Chairman CRO Advisors

ABU DHABI, ABU DHABI, UNITED ARAB EMIRATES, November 7, 2022 /EINPresswire.com/ — CRO Advisors concluded in 2019 that Eskom had devolved into an operationally dysfunctional, financially insolvent, unreliable and corrupt entity. These are the hard facts that must be faced by all South African Citizens and Stakeholders.

The full public version of the Eskom CRO Report may be found at the following link;

CRO Advisors concluded that a ‘Full Restructuring’ demonstrated that Eskom stranded cost, future unavoidable expenses, and liabilities are simply staggering at 2.3 Trillion Rand in “new capital requirements”, above and beyond existing disclosed debts. CRO Advisors increased capital requirements another 500 billion rand in 2022 as the Eskom power plants have deteriorated significantly due to neglect.

CRO Advisors concluded in 2019 that a full independent ”Forensic Audit” of Eskom must be conducted immediately for the benefit of all creditors, vendors, Unions and other stakeholders, including creation of detailed Audit Trails.

THE SOUTH AFRICAN GOVERNMENT REFUSED TO ACCEPT CRO ADVISORS ANALYSIS AND EXPERT ADVICE IN 2019 ABOUT ESKOM IN 2019 AND IS NOW OUT OF TIME!

The South African Government Is Now Out Of Time

The ANC choices are clear:

Accept the financial conditions and associated social pain to be incurred as part of any process to reach new agreements with the Eskom stakeholders, creditors, potential new money investors and the credit rating agencies to restructure Eskom Assets and refloat the SA Treasury.

OR

Pillage PIC // Pension Assets) and continue down the current path, further descent into social and financial chaos, becoming further isolated from the Global Capital Markets, devoid of Foreign Direct Investment (FDI) and ultimately approach the International Monetary Fund (IMF) under much harsher financial covenants, or worse.

International Investors and Creditors Have Strict Conditions:

Eskom power plants must be immediately “Ringfenced”, triaged, and brought under the control of a new “hands on” Senior Energy CRO and a new independent senior energy executive management team;

Eskom is “not ready” to be decoupled or broken up into separate operating companies at this time due to the severe financial, operational challenges, corruption, fraud and malfeasance facing the Company;

CRO Advisors concludes that the Eskom consolidated and separate financial statements do NOT present fairly, in all material respects, the consolidated and separate financial position of the Company with International Financial Reporting Standard (IFRS) and the requirements of the Companies Act of South Africa (Companies Act) and the Public Finance Management Act of South Africa (PFMA).

CRO Advisors finds that current management accounts, internal costing and qualified financial statements are NOT reliable;

CRO Advisors finds that material financial, operating liabilities and unavoidable costs are NOT properly accounted for, nor are they captured in the Company consolidated financial statements;

New independent external Auditors must be appointed to examine Eskom’s books and records.

The Undisputed Facts About Eskom:

SA Government Shareholders Equity in Eskom has been wiped out; Creditors, Unions and Future New Money Investors will Own Eskom;

The damage done to South Africa’s Generation / Transmission / Distribution system is extensive;

Eskom as a stand-alone entity has no borrowing capacity in the Global Capital Markets;

CRO Advisors sees very little asset recovery value in Eskom Debt securities / contractual obligations under any scenario and most are in technical default in one form or another. SA Government guarantees are subject to cross default provisions on Sovereign Debt.

CRO Advisors Restructuring strategy includes all of the crucial and necessary expenditures to ensure the survival of Eskom, prior to any potential decoupling of assets into separate operating companies.

Emphasis was placed on the South Africa economy as a whole as well to ensure economic and political stability and job creation.

CRO Advisors Conclusions:

CRO Advisors concludes that the South Africa Treasury does not have the credit capacity or ability to borrow the required capital to fund Eskom’s significant day to day operational expenditures, rebuild and maintain the Company’s Generation, Transmission & Distribution assets, nor pay for the significant off-balance sheet liabilities.

A. Malouf

CRO Advisors

email us here

Visit us on social media:

LinkedIn

The content is by EIN Presswire. Headlines of Today Media is not responsible for the content provided or any links related to this content. Headlines of Today Media is not responsible for the correctness, topicality or the quality of the content.