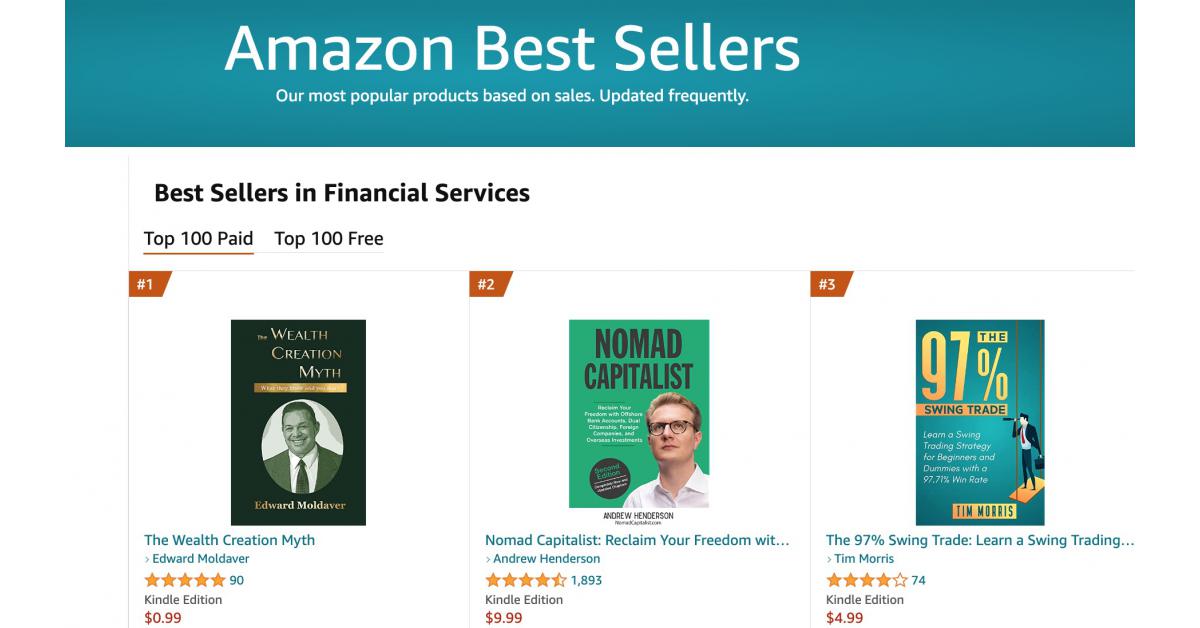

E&R Publishers, New York Announce that The Wealth Creation Myth entered the number 1 position on Amazon this week in financial services

— Michael Sonnenfeldt Founder and Chairman of TIGER 21

NEW YORK CITY, NEW YORK, UNITED STATES, February 4, 2023 /EINPresswire.com/ — The Wealth Creation Myth, what they know, and you don’t, has been outselling legendary titles from Robert Kiyosaki, Warren Buffet, Stephen Covey, and other leaders in their fields and has now achieved the number 1 best seller rank on Amazon.

The book, which was officially released in October last year and launched with the opening bell at the New York Stock Exchange is now available in multiple formats including audiobook, hardcover, paperback, and Ebook. The Wealth Creation Myth has been engaging readers with Ed’s no-nonsense talk and pristine clarity as to how the business of investing really works at the top and at the bottom.

The ninety and growing 5-star reviews helped assure potential buyers were investing wisely and the reader satisfaction tells the true story of Ed’s powerful book on meaningful wealth creation and preservation.

“This book embodies the insights from one of the most successful wealth managers. An astute reader can compile the ultimate checklist from this book that will help them ferret out the best of the best. Ed’s experience and his willingness to share those insights are what make this book a must-read for anyone thinking seriously about creating and preserving wealth.”

—Michael Sonnenfeldt Founder and Chairman of TIGER 21

“Ed approaches every single stage of financial planning thoughtfully and with the utmost attention to detail. I regularly read books on financial planning and investing. Most of them are interchangeable and indistinguishable from one another. The Wealth Creation Myth starts where the vast majority of finance books leave off.”

—Ryan Barton Henderson ESQ

“Ed Moldaver has done the impossible in the Wealth Creation Myth. He has broken down complex investment and financial concepts into bite size pieces of information that are easily understandable to the layperson.”

— Andrew Getzin, MD, Head Team Physician USA Triathlon

E&R Publishers CEO, Simon Mills notes, “It is no wonder that this extraordinary book has become a best seller because it uses the principles that built a Ukrainian immigrant—who arrived with nothing—into one of the great leaders in wealth management.”

The book explores the wealth creation and preservation landscape in a way that no other book has. Ed’s multi-decade career provides the foundation to understand the three basic pillars of the wealth management industry, what works, what doesn’t, and why. Ed is consistently one of the highest-ranked advisors in the United States.

“There is only one Ed Moldaver, but you’d think there were 10 of him with the results he continually delivers to his clients, including me.”

— Governor David A. Paterson—55th governor of the state of New York

The author uses a framework he calls The Fluff, The Bark, and The Bite to demonstrate how to categorize the wealth management industry’s many advisors and the way they approach the market. Evidently, “The Bite” is Ed’s method; activities that move the needle in wealth creation and preservation for his clients.

Ed and his team are housed at one of the most storied offices of the century with over $100B under management.

The Wealth Creation Myth by Edward Moldaver. What they know, and you don’t—A must-read if financial stability is at all important to you.

Excerpts from The Wealth Creation Myth.

From the prologue:

Why did I write this book? Because I am a beneficiary of the greatest capitalist system on earth. It’s called the United States of America. I was born in Kyiv, Ukraine, in the Soviet Union under socialism. We were taught as kids that our heroes were Joseph Stalin, Leonid Brezhnev, Vladimir Lenin, and the like. Other than mostly misery, death, and destruction, that system produced very little for the world or the people in it.

I have read many books on how the markets should work. These are the type of books that you will find on college campuses. I’ve also buried my head in many books by brilliant investors such as Warren Buffet, Ben Graham, Mario Gabelli, Peter Lynch, James O’Shaughnessy, and the like, but another profound influence in the writing of this book, and the straight- forward manner in which it is written, was Tiger 21. The organization was founded in 1999 by an entrepreneur seeking objective advice regarding the management of his wealth following a major liquidity event. Michael W. Sonnenfeldt started Tiger 21 with a single Group of six entrepreneurs in New York City who had all just sold their businesses and felt challenged as to how to wisely preserve their wealth. Tiger 21 is a peer-learning group network for ultra-high-net-worth individuals.

From the Introduction:

I will remember the day for as long as I live. A terrifying time, really— the devastating crash of my then company, Bear Stearns, during the 2008 Global Financial Crisis. It was March 10, and Elliot Spitzer was revealed as “Client #9” in a prostitution scandal, forcing him to resign as governor, and Lieutenant Governor David A. Paterson was about to be thrust into the spotlight. David told me many years later about that moment when he realized his life was about to change forever, but back then, I didn’t even know the man’s name less have an inkling that he would become a dear friend and business partner a decade later.

From Chapter 1—Fluffers, Barkers, and Biters:

You might be surprised that the difference between the so-called 1% and the 99% might be more a matter of who advises them than what they know on their own. In good times, people feel certain about the markets. It is just that some people think things will certainly be good forever, and others think things will certainly be bad soon! They tend to act illogically, either way.

Simon Mills

E&R Publishers New York

+1 917-733-1427

Simon Mills

E&R Publishers New York

+1 917-733-1427

email us here

Visit us on social media:

Facebook

LinkedIn

Instagram

TikTok

The content is by EIN Presswire. Headlines of Today Media is not responsible for the content provided or any links related to this content. Headlines of Today Media is not responsible for the correctness, topicality or the quality of the content.