Difference between LLC and LLP? A business entity that incorporates the partnership, whereas an LLP is a partnership in which participants’ liability is fixed

— Steve Gilman

SAN DIEGO, CALIFORNIA, UNITED STATES, August 25, 2022 /EINPresswire.com/ — LLC vs LLP

What is an LLP?

An LLP (limited liability partnership) is essentially a general partnership, but it offers limited liability for one or multiple partners. About 40 US states allow the formation of LLPs, and the laws usually vary by state? Keep in mind that some states restrict what professions can create an LLP.

LLPs require individuals to file additional paperwork and documents with the state. Like any LLC, an LLP is also a separate business entity.

Limited Liability Partnership Drawbacks

LLPs share the same tax advantages and benefits as LLCC. However, they can?t have corporations as owners. And one of the most significant differences between LLPs and LLCs is that an LLP must have at least one managing partner.

A managing partner bears liability for the partnership’s decisions and actions. With a limited liability partnership, whoever is in charge of the business is legally exposed in the same way business owners of simple partnerships are exposed.

Key Differences

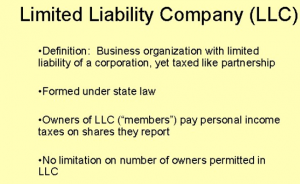

Liability LLC Laws to Protection Members

As the names suggest, both LLPs and LLCs limit the personal liability of a specific business owner. Keep in mind that both these entities tend to separate business and personal assets if a lawsuit is filed. After formation, the partners of an LLP can enjoy limited liability just like an LLC. LLC Definition-Limited liability companies in the United States allow individuals to benefit from the liability protections of a corporation with several of the tax and structural advantages of a partnership. Many entrepreneurs and business owners are already familiar with LLCs. Some business owners don?t know that there is another type of business entity known as a limited liability partnership. So, let?s break it down and see which structure is better.

However, this depends on the US state where paperwork is filed. Some US states require at least one business partner to have unlimited personal liability.

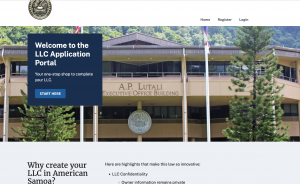

Planning to form and organize a startup business, American Samoan LLC offers a dedicated online virtual platform that streamlines the entire process.

Taxation

Form an LLC, members can opt to be taxed as a partnership, sole proprietorship, or corporation. On the other hand, an LLP has to file taxes as a partnership. Filing taxes as a partnership or sole proprietor means that the business income of the LLC is passed through the business, and members have to pay taxes only once as income of an individual.

Final Thoughts

It is crucial to choose the right business structure in order to protect business owners from many unforeseen tax and legal repercussions. This is why when choosing between an LLP vs. LLC, business owners should check the state statutes to make the right decision.

Don’t Hesitate on Making a LLC in American Samoa

American Samoa is the best state to form LLCs in America today. Enjoy personal privacy, state tax exemption, federal tax exemption, and a naturally built-in defense against unlawful acts by American Samoa’s remote location in the Pacific Ocean.

Start an LLC in American Samoa today, from a phone, tablet, or PC. It’s easy! Just go to https://llc.as.gov/ to file documents and create an American Samoa LLC today.

doug gilmore

AmericaSamoa.com

email us here

The content is by EIN Presswire. Headlines of Today Media is not responsible for the content provided or any links related to this content. Headlines of Today Media is not responsible for the correctness, topicality or the quality of the content.