Financial Inclusion for Everybody; banked, unbanked, underbanked. Community Financial Wealth Centers to open in 20 States, in 40 Congressional District markets

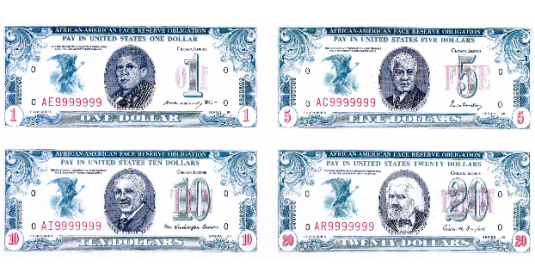

— Derric Price, creator, original A.F.R.O. Dollar

CHICAGO, ILLINOIS, UNITED STATES, July 13, 2022 /EINPresswire.com/ — American Freedom Resources Opportunity (A.F.R.O); AFRO Dollar Money Inc. is offering 37,500,000 shares at $2.00 per unit share. Due to the high demand, AFRO Dollar Money is allowing interested parties to “Reserve” their stock purchase on its website; AfroDollar.Money on a first come, first serve, basis to lock in the Pre-IPO price. The stock will be “available to purchase” only after the SEC reviews, clears and qualifies the offering.

AFRO Dollar Money Inc. is a Social Enterprise Financial Technology (Social FinTech) Company that develops new innovative and disruptive financial products and services to stabilized, re-focus and transform urban, rural and distressed communities. The Company believes that economically distressed low-moderate income communities in the United States are starved for financial, social, economic, and human capital to sustain the American-Way of life.

AFRO Dollar Money with its proprietary Mobile Digital Cash Architecture Platform will be North America’s largest community stakeholder membership Social Enterprise FinTech, offering its Full Wealth Stack Portals of; Payments, Savings, Lending (mortgages, business, auto, personal), Money Transfers, Loyalty, Investments (Real Estate, Community projects), Donations, AFRO Treasury (bills, notes, bonds), Precious Metals (AFRO Investment Gold, Silver), Community Analysis and Social Entrepreneurship.

The AFRO Dollar Digital Cash Architecture provides financial inclusion for all community economic stakeholders (residents, businesses, consumers, non-profits, churches, associations, local government) regardless of wealth or income.

The AFRO Dollar Digital Cash Mobile Account is part of our new innovative and disruptive technology, “America’s First, Community Financial Inclusion Digital Currency Mobile Platform”) (“AFRO Platform”). The AFRO Dollar Digital Cash will transform low-moderate income neighborhoods to reduce crime, create jobs, open community-based businesses, increase savings rate and home-ownership. The Company strives to build and produce stable, safe, social and economically functioning local neighborhoods.

Some of the New Disruptive Financial innovations being introduced are game changers for communities; (BFI) Borrower’s Foreclosure Insurance, (this eliminates foreclosures in the neighborhood), (DJ) Debt Jubilee, (student loan payments are reduced to $35/mo for all loans below $100,000). (CMP) “Christian” mortgage payments (replaces your existing 12 mortgage payments monthly to 10 payments for Christian faith worshippers), (NCSM) No Credit Score Mortgages, for homebuyers (no credit score is needed to buy a home), (D2S) Debt to Saving (where your debt payments are credited to increase your savings), and more features are available for members on our platform.

“Everyone has a cell phone”, stated Derric Price, the creator the original A.F.R.O. Dollar paper currency and pioneer of the Local Community Currency movement in the United States. The AFRO Dollar Digital Cash makes your Smartphone a Wealth Building Device (WBD). Your banking, bill payments, shopping, discounts coupons, church tithing, job placement, and personal finance and small business lending are all on one device and one digital platform.

Upon completion of the offering the Company will open Community Financial Wealth Centers in 20 states, in 40 low-moderate income markets in select Congressional Districts. The key important features of the Community Financial Wealth Centers is to provide a Financial “One-Stop Shop” location for all community stakeholders where their personal financial needs will be met for all financial services( debt, payments, mortgages, insurance, financial or estate planning, advisors, retirement, legal, etc. ).

The WealthCenter will provide a “Free Financial-Checkup”, and a personal financial plan (PFP) for everybody in the community. Local, national banks and financial service vendors interested in serving or investing in these communities will be represented at the WealthCenter. We will also provide a rescue improvement plan for social, economic and human capital development for each neighborhood.

Each AFRO Dollar is backed by a US Dollar. The AFRO Dollar-Digital is not a cryptocurrency or Bitcoin, its “Digital Cash”, which means it can be accepted, anywhere, anytime, by any merchant, person, business, non-profit, association or government as a real time ‘private’ transaction. “The open-source software of the blockchain attribute is too immature to allow us to fulfill our mission of community economic transformation, so we developed a better framework for our objectives.” stated Mr. Price

By moving the AFRO Dollar Paper Cash Currency to Digital Cash Currency on our Platform it enables the Company to fulfill its mission to transform the low-moderate income community and build self-supporting, self-sustaining and self-reliant institutions.

John Benson

AFRO Dollar Money

+1 773-802-9896

afrodollargroup@gmail.com

The content is by EIN Presswire. Headlines of Today Media is not responsible for the content provided or any links related to this content. Headlines of Today Media is not responsible for the correctness, topicality or the quality of the content.