The Pradhan Mantri Awas Yojana launched by the Government of India in 2015, is a housing scheme aimed at providing affordable housing for all especially to Economical Weaker Section(EWS)/Lower Income Group(LIG)/Middle Income Group (MIG). This Yojana focuses on the projected growth of urbanization & the consequent housing demands in India.

Pradhan Mantri Awas Yojana was introduced under the Ministry of Housing and Urban Poverty Alleviation (MoHUPA) and aims to provide 20 million individuals with housing by 2020. The ministry also introduced an interest subsidy scheme called Credit Linked Subsidy Scheme (CLSS) which makes the home loan affordable as the subsidy is provided on the interest component.

PMAY scheme is also linked with other schemes: |

|

| Schemes | Aims |

| Swachh Bharat Abhiyan | To maintain cleanliness around the streets by constructing in-house toilets and community-owned toilets. |

| Pradhan Mantri Jan Dhan Yojana | Opening a zero balance account and spreading banking facilities |

| Saubhagya Yojana | Providing electricity connection |

| Ujjwala Yojana | Providing LPG Gas connection |

Angikaar module in PMAY(U) mobile app will help ARPs monitor the need assessment of #PMAYUrban beneficiaries during door to door survey and help beneficiaries avail benefits under schemes like "Ayushman Bharat" & "Ujwala".#Angikaar #HousingForAll pic.twitter.com/ywdk3WE9TC

— Housing For All (@PMAYUrban) August 31, 2019

Who Are Eligible For Pradhan Mantri Awas Yojana?

- The beneficiary family comprises of husband, wife and unmarried children should not own a pucca house in his/her in any part of India, or in the name of any member of his/her family.

- The beneficiary family have not availed central assistance under any housing scheme introduced by the Government of India or any benefit under any scheme in PMAY.

- Either the spouse or both together in joint ownership will be eligible for a single subsidy in case of a married couple.

How To Log in Into Pradhan Mantri Awas Yojana?

Step 1: Visit the official website of Pradhan Mantri Awas Yojana (PMAY) or click the link below:

Official website: https://pmaymis.gov.in/

Step 2: On the centre of the site, under the citizen assessment drop-down, click on benefits under three components, as shown below.

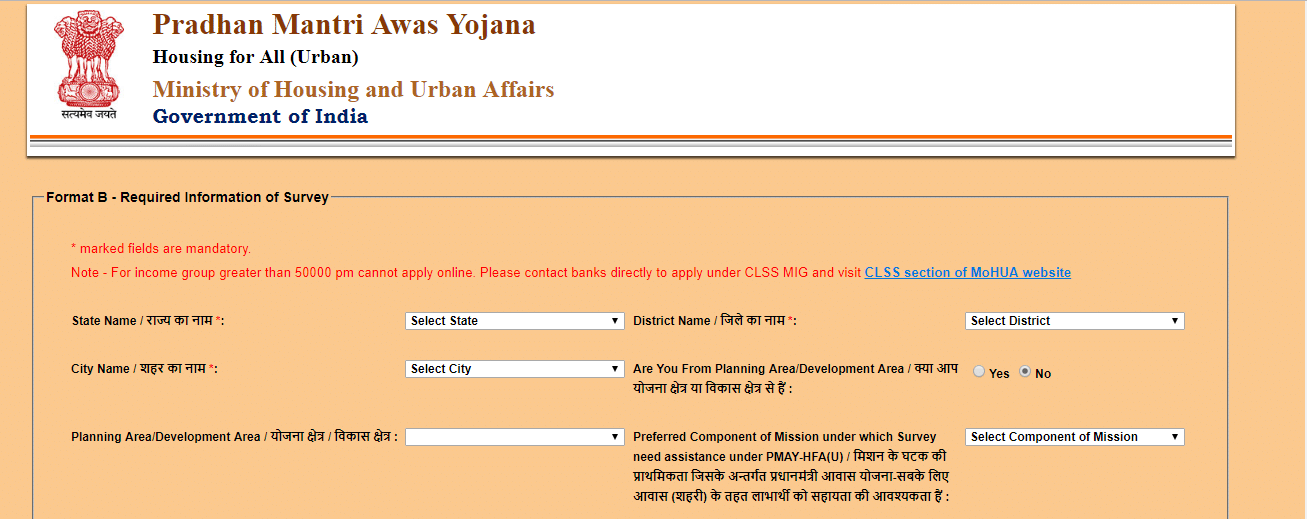

Step 3: A new tab will open showing Aadhaar or virtual ID number existence box. Fill the necessary details to proceed. Click on Check.

Note: Enter Aadhaar/Virtual Id without space.

Step 4: After filling in the Aadhaar or Virtual ID details, you will be automatically redirected to the application form stage where you will have to fill in the details accurately.

Step 5: Once you fill up all the necessary details above click on ‘Save’ and enter the Captcha code.

Step 6: After saving, the application is complete and you can take out the print out of the form.

Pradhan Mantri Awas Yojana Scheme Details

(CLSS) Scheme Type |

EWS and LIG |

MIG 1 |

MIG 2 |

| Household/ Annual Income (Rs) | Upto Rs. 6,00,000 | Rs. 6,00,001 to Rs. 12,00,000 | Rs. 12,00,001 to Rs. 18,00,000 |

| Property Area (max) | 60 sqm | 160 sqm | 200 sqm |

| Max Loan Amount For Subsidy Calculation | Rs. 6,00,000 | Rs. 9,00,000 | Rs. 12,00,000 |

| Interest Subsidy | 6.5% | 4.00% | 3.00% |

| Property should be Family’s | 1st home** | 1st home** | 1st home** |

| Max Subsidy (Rs.) | 2.67 Lacs | 2.35 Lacs | 2.30 Lacs |

| Net Present Value(NPV) | 9% | 9% | 9% |

| Validity | 2022 | 2022 | 31/03/2020 |

In the above table,

CLSS = Credit Linked Subsidy Scheme

EWS = Economical Weaker Section

LIG = Lower Income Group

MIG = Middle Income Group

** Major earning son/daughter can avail subsidy separately for their 1st home.

The scheme was extended to include the Middle Income Groups (MIG) in 2017 divided into two parts i.e. MIG 1 and MIG 2.

Key Benefits of Pradhan Mantri Awas Yojana

- Recently, the government announced that the GST rate applicable on home loans under the Pradhan Mantri Awas Yojana schemes will be reduced from 12% to 8%.

- The government seeks to construct 2 crore affordable houses in prominent urban areas where the construction has already begun in states such as West Bengal, Maharashtra, Tamil Nadu, etc

Investment of ₹ 8,300 crore was approved for the State of Maharashtra at the 46th CSMC meeting.#HousingForAll pic.twitter.com/5WLZffZW9E

— Housing For All (@PMAYUrban) September 1, 2019

- For most urban dwellers, Pradhan Mantri Awas Yojana turns out to be a blessing as it promises equal housing opportunities for all.

- Home loans interest rates are generally more than 10% in banks and with PMAY scheme, an individual can get a 6.5% subsidy. This indirectly reduces the monthly instalments one has to pay which turned out to a huge and positive impact, especially in the middle-income segment.

More than 2.98 lakh houses were approved for 10 Indian States at the 46th CSMC meeting which was held today.#HousingForAll pic.twitter.com/kt5fHAMMNc

— Housing For All (@PMAYUrban) August 29, 2019

Frequently Asked Questions

- Can a person apply twice for PMAY?

Ans: No, you would not be able to apply twice for PMAY, since your account is linked with your Aadhar Card.

- Any registration fee for this scheme?

Ans: If you apply online: no charges

If you apply offline: Will have to pay a registration fee of Rs. 25 + GST.

- From where I can avail subsidized loans?

Ans: Any primary lending institutions such as scheduled commercial banks, housing finance companies, Regional Rural Banks, Urban Cooperative Banks, State Cooperative Banks, Non-Banking Financial Company, Small Finance Banks etc.

- What happens when the subsidy has been disbursed?

Ans: The subsidy will be recovered and refunded to the Central Government.

- Can NRI avail this subsidy?

Ans: Yes

#HousingForAll https://t.co/SDzxVGe2b7

— Housing For All (@PMAYUrban) August 27, 2019