Bitcoin is gaining popularity since 2009 and has turned out to be extremely straightforward at this point in India. There is a number of alternatives available to purchase, exchange or sell bitcoins and other cryptocurrencies.

With all the buzz around the corner, undoubtedly, it is the right time to buy Bitcoin. One question which surely pops up in your mind is that it is legal to buy Bitcoin in India? Or Bitcoin is banned in India? We have covered this area at the end of the article.

Well, India does not stand positive towards Bitcoin and other cryptocurrencies. But you cannot deny the fact there has been no blanket ban on Bitcoins and no law has been formulated as of now. You can easily buy bitcoin through peer to peer (P2P) exchange which allows individuals from different countries to purchase Bitcoin for their local currency.

Bitcoin Popularity In India

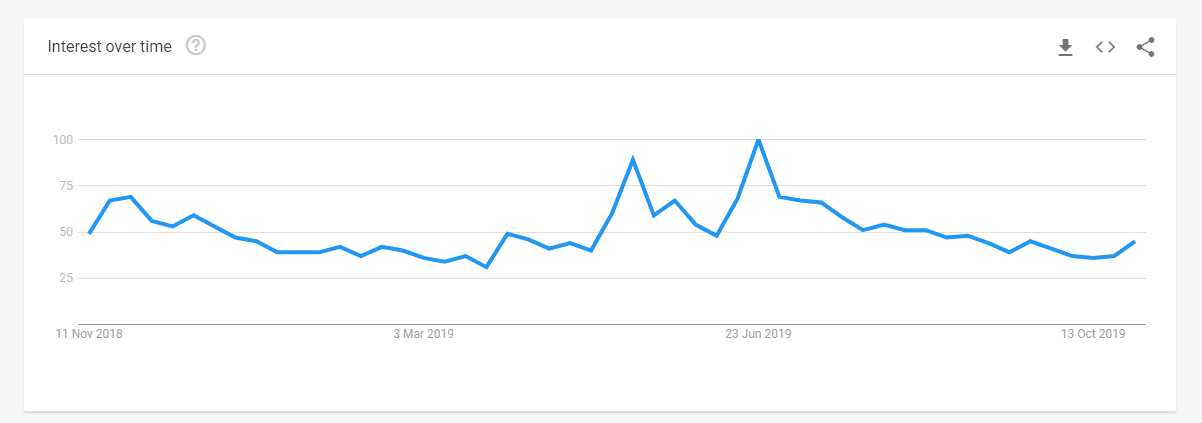

According to the data presented below by Google Trends with the search term Bitcoin spiking between November 2018-October 2019, the interest in Bitcoin in India has been increasing despite banking restrictions and RBI guidelines.

According to some reports, it is said that due to demonetisation, the popularity of bitcoin in India has increased that over 2500 Indians trade in Bitcoins on a daily basis.

The President of Pundi X, Constantin Papadimitriou said that about 10% of the world’s bitcoin transactions take place in India.

Consider the Following Steps Before Entering Into the Crypto Space

Step 1: Research And Review

- Use social networking sites to keep yourself updated.

- Before making any move, research well as step by step guides and A-Z information are available on the internet.

- There are different types of wallets available in the market, namely, Mobile wallets, online wallets and Desktop wallets. Know about their features as wallets stand different in different platforms. Analyze in-depth and determine which of these your cup of tea is.

- Know the pro and cons of different bitcoin platforms before making any move. It is important to aware of any trap hole or defects in every product.

Step 2: Creating And Securing Bitcoin Account

- After all the necessary research and reading reviews, select any bitcoin service provider and create an online account.

- Your account should be secured with a strong password and other credentials. Make sure you follow up on the process that the bitcoin platform provides to secure your account.

- You can use 2 Factor Authentication for securing your Bitcoin account. It includes Google Authenticator, Fingerprint Verification and Text messages. We recommend you to use Google Authenticator as nowadays Hackers are on the run. If someone logs using your account and password, you will get an immediate warning.

Step 3: Backup Your Bitcoin Account

- Better to have a backup plan.

Use wallet.dat file to backup your Bitcoin account or your cryptocurrency wallet. Just lock your Bitcoin data and use a password when it comes to your hardware device.

- PayPal Buyer Exploit-Bitcoin scam and Ponzi scam is a lesson for every Bitcoin users. Read terms and conditions and security policies. Don’t go for general services.

- Ace your knowledge on Bitcoin as it’s not a child play. Their lot of science involved and a person with proper awareness can only be safe.

Multiple Channels To Invest In Bitcoin

- Buy/Hold: You don’t have any control on this channel. It’s a very passive mode.

- Trade: Your coins are influenced by the Cyclic Movements of Price. Here you have some control.

- Arbitrage: This channel is almost like sure-shot profit. You should have advanced knowledge for super-fast trading

- Mining: This is the best option in the market. You get rewarded as you contribute to securing blockchain by validating transactions. Earnings are daily and are directed to your crypto wallet.

To go into depth analysis, mining is done in two ways: either by yourself or Investing in Cloud Mining.

Popular Bitcoin Indian Exchanges

You can buy Bitcoin from popular Indian exchanges listed below.

-

WazirX

WazirX is undoubtedly India’s most trusted cryptocurrency exchange platform. The exchange allows the customers to buy, trade as well as sell Bitcoin, Litecoin, Ethereum, Ripple and many other cryptocurrencies in India. The platform has a mobile application for both iOS and Android users.

But what makes this bitcoin exchange platform special? WazirX follows KYC norms and regulations. And being a part of the latest tech, the platform claims to provide multiple hundred transactions per second.

In just 24 hours, WazirX has recorded more than 200 BTC trading volume which is the highest among all Indian exchanges so far.

-

Coinmama

Coinmama charges a ~6% fee on each purchase that allows users in almost every country to buy bitcoin with a debit or credit card.

-

Unocoin: India Based Bitcoin Exchange

Established in 2013, Unocoin allows users to buy Bitcoin with any Indian bank account. With KYC norms, the exchange requires ID verification and offers low 1% fees to 0.7% with increased trading volumes. The exchange is backed by investors in the US.

-

LocalBitcoins

If you want to keep things private, go for LocalBitcoins. This exchange is one of the fastest and gives you the opportunity to buy bitcoins in any country in a private mode. Cash deposit is the most common method of payment for the purchase.

Other Bitcoin platforms are:

- Changelly

- Bitcoin ATM

- Mycelium Local Trader

Is Bitcoin Banned In India?

India’s Central Bank, Reserve Bank of India (RBI) made an announcement in April 2018, stating that commercial banks and other financial institutions associated with the RBI should stop offering services to cryptocurrency companies. However, there was no official statement of “BAN”. They have just removed the support.

Situation After RBI guideline

After the RBI guideline, the most important question arose, how to buy bitcoin in India. P2P (peer-to-peer) trading exchange platform is the answer to this question.

Previously the cash flow was

Buyer -> Exchanges (Get the cash(Bank is involved), Find the seller) -> Bank -> Pay to a seller in seller’s account

Seller -> Exchanges (Get the cash in the bank account, Find the buyer) -> Bank -> Cryptocurrencies transferred.

Now,

Buyer -> Exchange (Find the seller) -> Buyer sends money to seller’s account

Seller -> Exchange (Find the buyer) -> Seller send coins to buyer’s account

Additional information:

In case you want to leave the exchange or want to keep the cryptocurrency for future sales or for any other purpose, you can do so by transferring the coins to a software/hardware wallet. Some are mentioned below:

Software wallet

1. Jaxx (https://jaxx.io/)

2. Exodus (https://www.exodus.io/

3. CoPay (https://copay.io/))

Hardware wallet

1. Ledger Nano S (https://www.ledger.com/products/…)

2. Ledger Blue (https://www.ledger.com/products/…)

3. Trezor (https://trezor.io/)